pinellas county sales tax 2021

However if the agent fails to collect and pay the tax the owner will be held liable for the taxes. The latest estimates put the rate reduction to take place sometime during 2024.

Pinellas County has one of the highest median property taxes in the United States and is ranked 640th of the 3143 counties in order of median property taxes.

. The Pinellas County Commission discusses the 2021 millage rates at its meeting July 30. As we began Fiscal Year 2021 we faced a great deal of uncertainty amid the COVID-19 pandemic. Just in time for the opening of Pinellas County schools on Aug.

So the current Florida sales tax rate on commercial rent as of January 1 2022 is 55 plus the local discretionary surtax rate. The total sales tax rate in any given location can be broken down into state county city and special district rates. Tax Rates By City in Pinellas County Florida.

The most populous location in Pinellas County Florida is Saint Petersburg. Start filing your tax return now. Property taxes must be paid in full at one time unless on the partial payment plan Multiple checks must be sent in the same envelope.

Going Out Of Business. Pinellas County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Pinellas County totaling 1. 2021 List of Florida Local Sales Tax Rates.

There was legislation to reduce the rate to 54 in 2021 but the legislation was never enacted because the economic tsunami of Covid-19 started to hit while the legislation. The median property tax in Pinellas County Florida is 1699 per year for a home worth the median value of 185700. The Pinellas Park sales tax rate is.

2021 Jul 29 2021 Updated Jul 31. The Florida state sales tax rate is currently. The Florida sales tax rate is currently.

The December 2020 total local sales tax rate was also 7000. 1st installment payment for 2022 property taxes due by June 30. Pinellas County Florida A-7 FY22 Adopted Budget.

Sales tax dealers must collect both discretionary sales surtax and the state sales tax from the purchaser at the time of sale and remit the taxes. Any certificate struck to the county at a sale will not be available for purchase until the first business day of September. Official 2022 tax roll opens Nov 1.

Although the impact on property tax revenue is unknown the county can quantify the hit taken from the. 72 rows For several years the state reduced the commercial rental sales tax rate small amounts with the latest reduction to 55 plus the local surtax effective January 1 2020. What is the sales tax rate in Pinellas County.

The Penny and sales tax rates. Thomas Pinellas County Tax Collector PO. For more info about delinquent taxes please contact our office at 727-464-3409.

TAX DAY NOW MAY 17th - There are -416 days left until taxes are due. This is the total of state and county sales tax rates. Property Taxes in Pinellas County.

Tax Certificate Tax Deed. The 6 state sales tax applies to the full purchase price and the 1 Pinellas County local option sales tax applicable to the first 5000. Easily manage tax compliance for the most complex states product types and scenarios.

Did South Dakota v. What is the sales tax in Florida for 2021. 18 Apr 2000 Sale Price.

You can find more tax rates and allowances for Pinellas County and Florida in the 2022 Florida Tax Tables. Please call 727-464-5007 with any questions. In addition to the state sales and use tax rate individual Florida counties may impose a sales surtax called discretionary sales surtax or local option county sales tax.

Florida has a 6 sales tax and Pinellas County collects an additional 1 so the minimum sales tax rate in Pinellas County is 7 not including any city or special district taxes. Pinellas County collects on average 091 of a propertys assessed fair market value as property tax. The minimum combined 2022 sales tax rate for Pinellas County Florida is.

Once your application is processed you will receive an email with instructions. The sales tax rate does not vary based on location. This is the total of state county and city sales tax rates.

Update Address with the Property Appraiser. Write your account and phone on the memo line of your check in case we need to contact you. Box 31149 Tampa FL 33631-3149.

If you contract with an agentregistered platform to rent your property they should collect and pay the TD tax. To purchase Pinellas County held certificates register online at LienHub. The most populous zip code in Pinellas County Florida is 34698.

The average cumulative sales tax rate between all of them is 7. The Pinellas County sales tax region partially or fully covers 72 zip codes in Florida. Florida has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 15.

273000 Full Amount Stated On Document Buyer 2021 N Pointe Alexis Dr Tarpon Springs FL 34689 Loan. The County sales tax rate is. Remember that ZIP codes do not necessarily match up with.

A full list of these can be found below. Pinellas County Florida A-8 FY22 Adopted Budget. Voted to approve this one-percent infrastructure sales tax.

What is the sales tax rate in Pinellas Park Florida. Floridas statewide sales tax rate is 6 percent but a majority of county governments have a local sales tax of 5 to 2 percent for various purposes including infrastructure public hospitals emergency. 330000 Sales Price Or Transfer Tax Rounded By County Prior To Computation Buyer 2021 N Pointe Alexis Dr Tarpon Springs FL 34689 Details Type.

The current total local sales tax rate in Pinellas County FL is 7000. The minimum combined 2022 sales tax rate for Pinellas Park Florida is. Ad Accurately file and remit the sales tax you collect in all jurisdictions.

Roads bridges and trails. The Pinellas County sales tax rate is. Water quality flood and.

Pinellas County has a sales tax rate of 7 percent close to the statewide average rate of 68 percent. The 2018 United States Supreme Court decision in South Dakota v. As for zip codes there are around 71 of them.

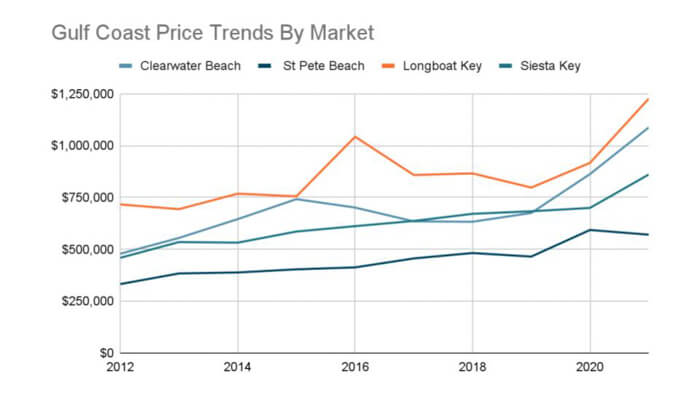

Market Updates Learn About The Gulf Coast Area At Mygulfcoastproperty Real Estate Blog

2021 Back To School Sales Tax Holiday July 31 August 9 2021 Paradise News Magazine

2022 Tax Free Weekend In Florida For School Supplies July 25 To August 7

2021 Used Ford Bronco Sport Big Bend At Auto Hub Serving North Brunswick Nj Iid 21238425

The Aesthetic Realtor Realtor Social Media Realtor Signs Real Estate Exam

2022 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Will Ben Jerry S Stay On Florida List Of Scrutinized Companies Wfla

How To Find Out If Your Condo Is Va Approved 2022

Presses Archive Solar Energy World

2021 Toyota Camry Xse Auto Awd Ratings Pricing Reviews Awards

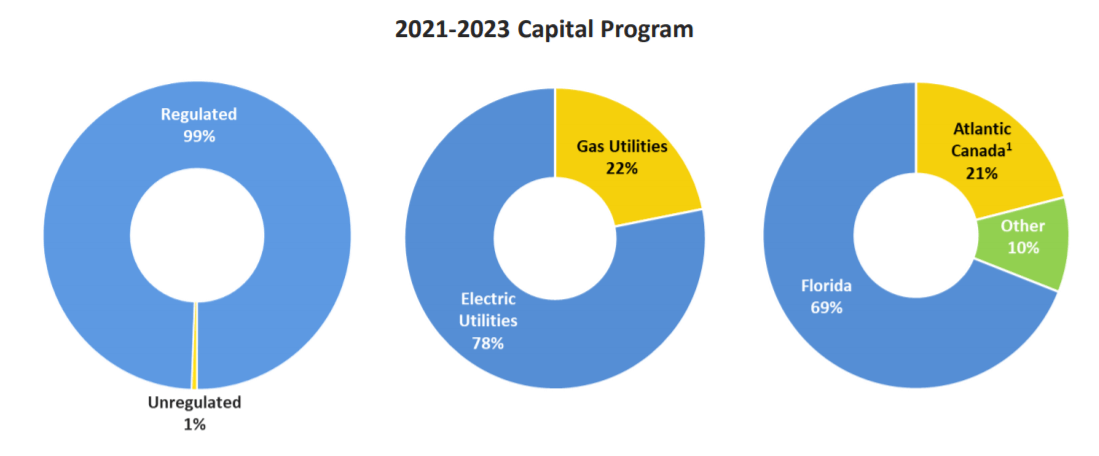

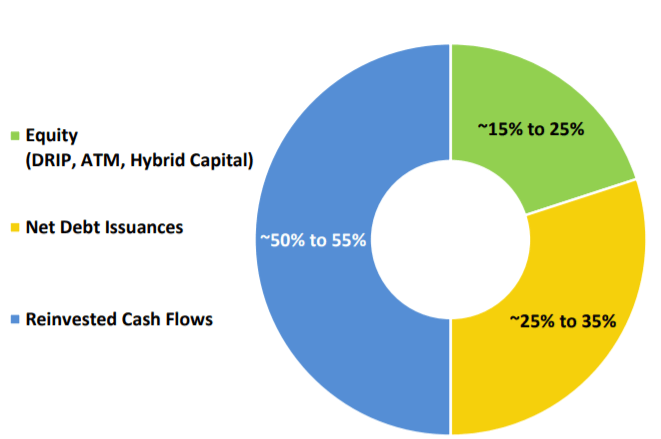

Emera Doubling Down On The Sunshine State Otcmkts Emicf Seeking Alpha

Ransomware Attack List And Alerts Cloudian

2021 Ford Bronco Suv In Clearwater Fl Walker Ford

2021 Toyota Camry Xse Auto Awd Ratings Pricing Reviews Awards

Your Ultimate Florida Contractor License Guide Lance Surety

Emera Doubling Down On The Sunshine State Otcmkts Emicf Seeking Alpha